The Challenges of Traditional Credit Risk Assessment: Why It’s Time for Change

In the fast-paced world of finance, effective credit risk assessment is crucial for the sustainability and profitability of financial institutions.

To become the frontrunner in delivering ML-driven credit risk management platform, empowering the financial industry to maintain the relevance and prowess.

To transform the finance sector by providing an all-encompassing software platform that enhances operational efficiency and elevates credit risk management to new heights.

In the fast-paced world of finance, effective credit risk assessment is crucial for the sustainability and profitability of financial institutions.

Small and Medium-sized Enterprises (SMEs) are the heart of any economy. They drive innovation, create jobs, and fuel local growth.

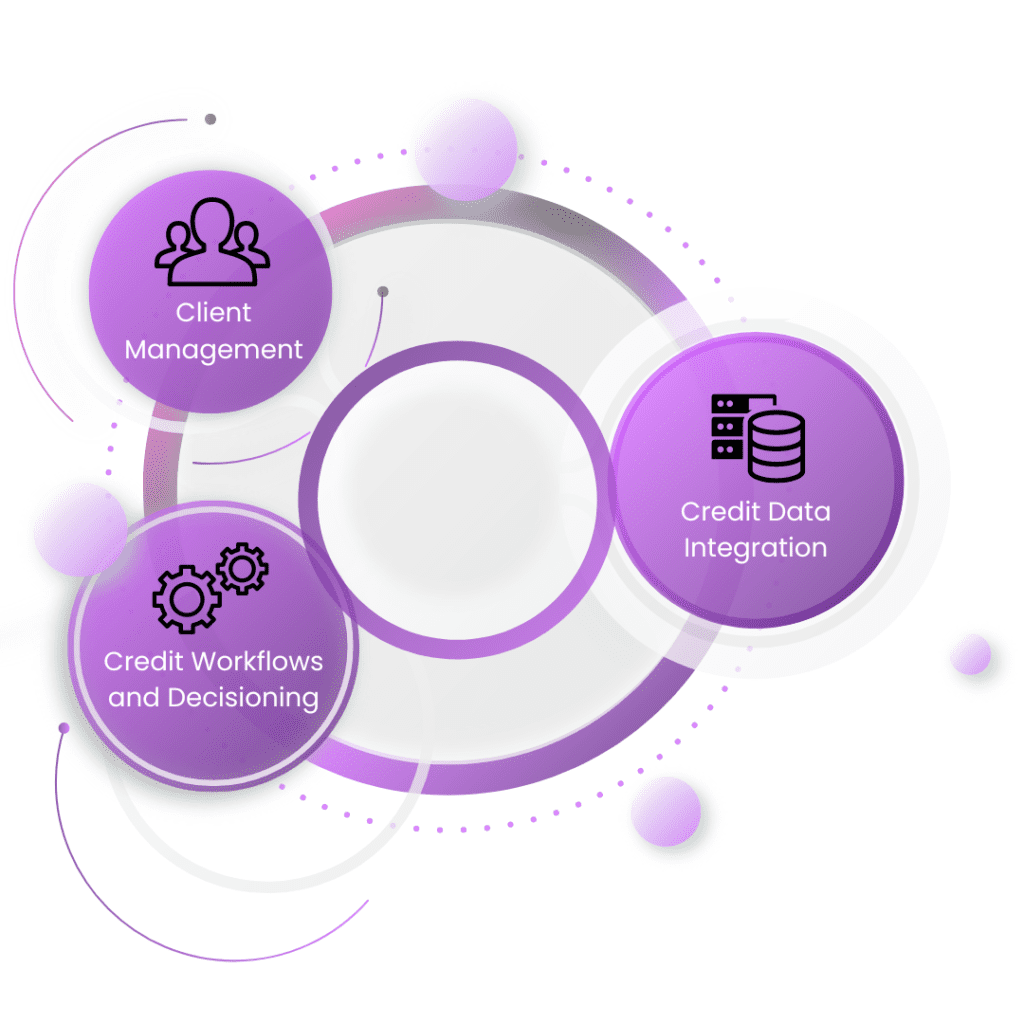

At CREDiTools Technologies, our value proposition is centered around revolutionizing client management and credit evaluation with cutting-edge machine-learning solutions.

At CREDiTools Technologies, we’re excited to unveil our all-encompassing, ML-driven credit risk management platform.

At CREDiTools Technologies, we’re excited to launch our pioneering credit risk management platform.

The credit rating software market is experiencing robust growth, particularly in North America, which holds the largest share of the global market.